Proof-of-Stake (PoS)

Operates on the principle that ‘everyone’ can win the chance to add a block to the blockchain, by using a system not much unlike a lottery. Used by: Ethereum (since sept 2022), Peercoin, NxtCoin, BlackCoin.

Basic principle

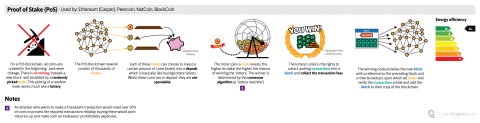

- On a PoS blockchain, all coins are created in the beginning, and never change. There is no mining. Instead, a new block will be added by a randomly picked (staking) node.

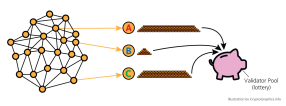

- The picking of this node works much like a lottery: nodes (‘operators’ of the blockchain) can choose to invest a certain amount of coins (stake) into a deposit, to become a validating node. While these coins are in deposit, they are not spendable.

- Out of these validator nodes, a random node is picked that will create a block. All other validator nodes will attest the block (validate it).

- Staking provides incentive for good behaviour: a staking node can lose a portion of their stake for things like going offline (failing to validate), or their entire stake for deliberate collusion. Rewards (coins) are given for creating new blocks and for attesting them, but if nodes attest to malicious blocks, they will lose their stake entirely.

Consensus

- The more coins a validator node invests, the higher its stake; the higher the chance of winning the ‘lottery’ 1. The winner is determined by the consensus algorithm (a ‘lottery machine’).

- The lottery’s prize is the rights to collect waiting transactions into a block and collect the transaction fees.

- The winning validator node provides the new block with a reference to the preceding block and is then broadcast, upon which all other validator nodes will attest (verify) the transactions inside and add the block to their copy of the blockchain.

- As there is no computational-intensive mining with Proof-of-Stake, if it where to receive an energy label, it would rate A+ for very energy efficient.

Notes

- An attacker who wants to make a fraudulent transaction would need to have control of over 50% of the validating nodes (and thus the staked coins) to process the required transactions reliably; buying the required coins would push the price up and should make such an endeavour prohibitively expensive. There’s very little incentive to destroy the value of a currency you have a majority stake in. There are stronger incentives to keep the network secure and healthy.

Sources/Further reading

Proof Of Stake – Ethereum.org

The Beacon Chain Ethereum 2.0 explainer